TechAlpha for Finance & Banking, Communicate with Confidence in a Risk-Sensitive World

Mistrust is rising. So are fraud attempts and compliance checks. TechAlpha helps financial institutions keep communication trusted, trackable, and compliant across alerts, OTPs, onboarding, and beyond.

Use TechAlpha’s SMS solutions to send alerts, collect feedback, and reduce drop-offs during transactions.

Solutions Tailored for the Finance Sector

From alerts and OTPs to reminders and feedback, TechAlpha helps financial teams communicate at scale without missing critical touchpoints. Whether you’re improving loan application workflows or sending fraud warnings, our tools are built to keep every message secure, compliant, and instant.

Automated Transaction Alerts

Trigger real-time SMS alerts for account activity, payments, and suspicious transactions.

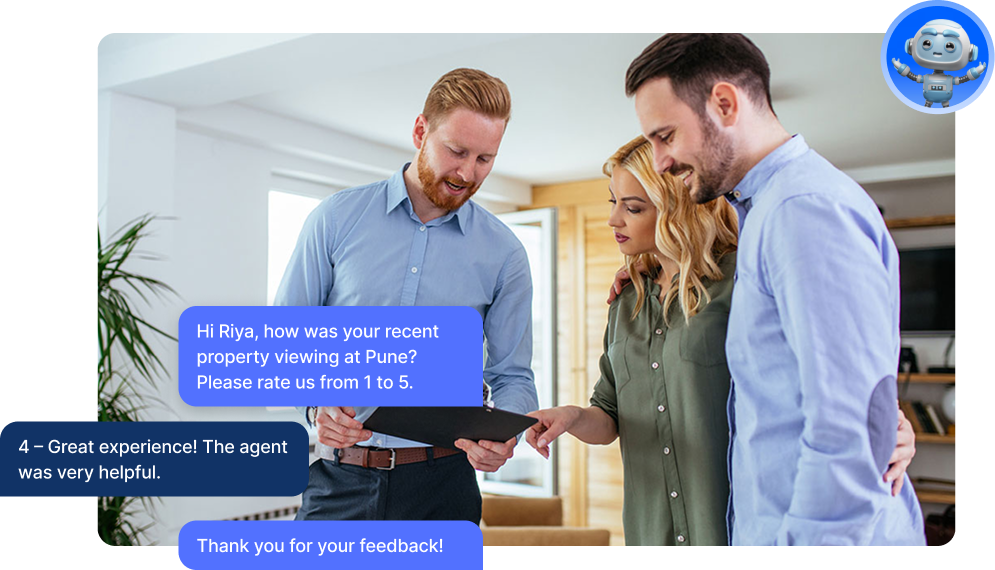

Client Feedback Collection

Gather NPS and CSAT post-call or post-visit to track service quality.

Compliance-Based Messaging

Built-in audit trails and delivery logs for every message to meet regulatory needs.

BENEFITS OF REAL ESTATE

Smarter Decision-Making

with Analytics

Real-Time Transaction Alerts

Why it Matters:

Customers expect instant updates on transactions. A delay can affect trust or trigger support tickets.

How it Helps:

- Sends real-time alerts for payments, withdrawals, or account access

- Confirms actions with two-way messages

- Helps detect fraud early by involving users directly

Impact:

Strengthens account security and builds user confidence through transparency.

Faster Loan and Credit Processing

Why it Matters:

Quick communication reduces drop-offs during loan or credit card applications.

How it Helps:

- Sends status updates and document requests

- Automates reminders for incomplete steps

- Tracks open and response rates to guide agent follow-ups

Impact:

Shortens time to approval. Improves user experience and increases completion rate.

Scalable Customer Support

Why it Matters:

High call volumes and support requests overwhelm teams. Automation brings relief without reducing service quality.

How it Helps:

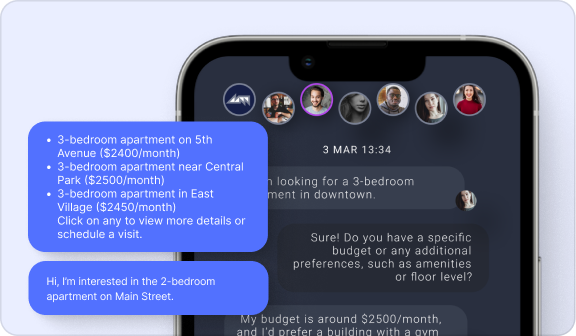

- Handles FAQs using chatbots on web and WhatsApp

- Routes complex cases to human agents

- Logs all interactions for compliance and analysis

Impact:

Boosts support capacity. Keeps service levels steady without expanding headcount.

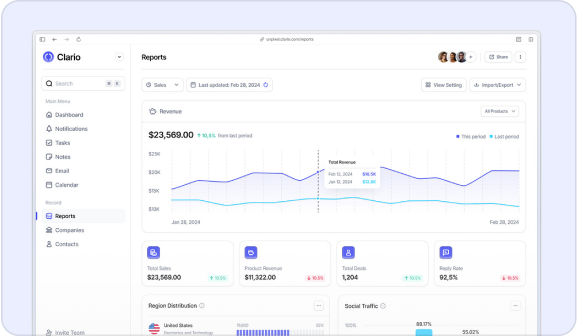

Data-Backed Campaign Optimization

Why it Matters:

Banks run frequent campaigns for new accounts, cards, or investment products. Without data, outreach becomes inefficient.

How it Helps:

- Tracks user behavior and conversion paths

- Identifies best-performing channels

- Helps refine content and timing

Impact:

Increases ROI from outreach and supports growth with smarter targeting.

Real-Time Transaction Alerts

Faster Loan and Credit Processing

Scalable Customer Support

Data-Backed Campaign Optimization

Results That Speak: Smarter Messaging in Finance

Digital leaders customize a differentiated, modern messaging experience with Sendbird. Explore the variety of ways by industry, team, and use case

Banking Partner

Credit Provider

Fintech Platform

Fashion Retailer

A global clothing brand used Tech Alpha’s platform to automate sale alerts and delivery messages. They saw a 32% increase in repeat purchases and reduced support tickets by 40%. The tools helped them run campaigns across WhatsApp, SMS, and email from one dashboard.

Credit Provider

A retail bank used Tech Alpha’s messaging platform to cut customer wait times by 60%. With automated alerts and chatbot-driven support, they improved daily query handling and saw higher app retention rates. They now use the solution across customer onboarding and service workflows.

Fintech Platform

A retail bank used Tech Alpha’s messaging platform to cut customer wait times by 60%. With automated alerts and chatbot-driven support, they improved daily query handling and saw higher app retention rates. They now use the solution across customer onboarding and service workflows.